- Which car brands are made in India? Oct 27, 2025

- Largest Textile City in India: Why Surat Tops the List May 4, 2025

- Biggest Steel Supplier in the US: Market Leaders, Facts, and Industry Tips Jul 30, 2025

- Who Still Dumps Garbage in the Ocean: The Role of Plastic Manufacturers Apr 3, 2025

- Navigating the Path to Small Scale Manufacturing Success Dec 22, 2024

Industry Insights: Manufacturing Trends, Pharma, Automotive & More

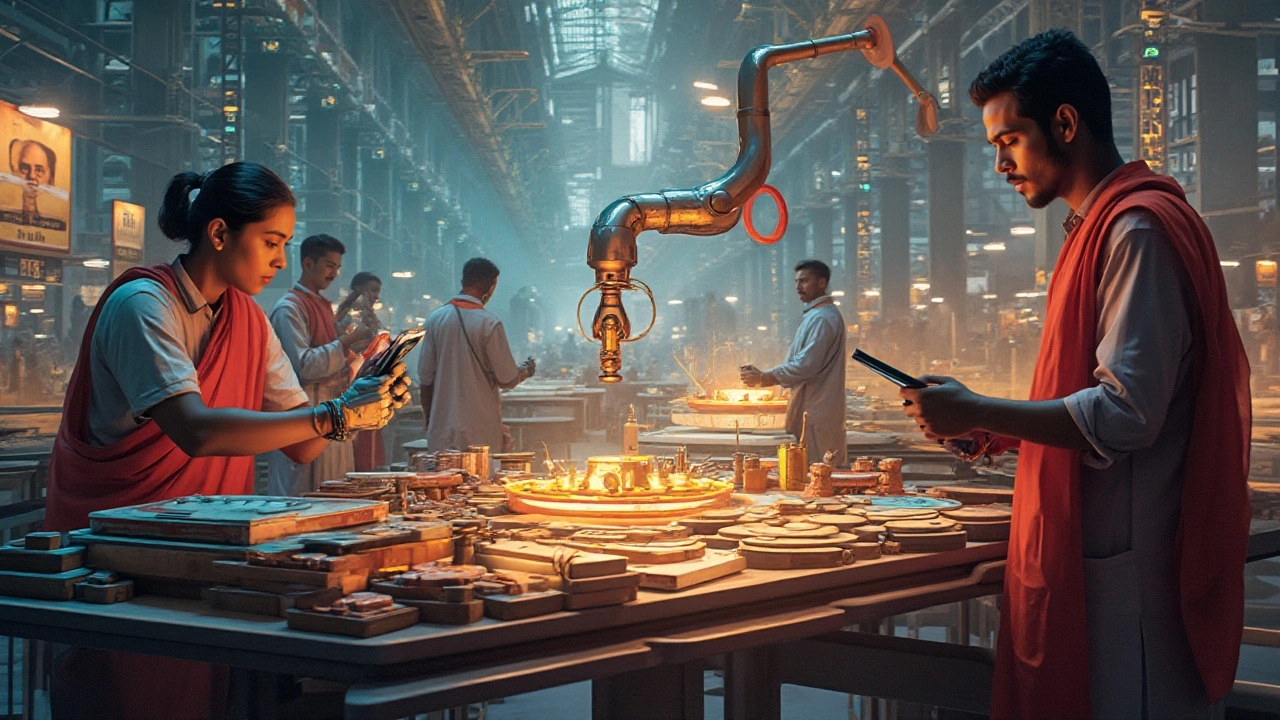

Looking for a quick pulse on what’s really moving the Indian industrial scene? You’re in the right spot. Below you’ll find straight‑to‑the‑point analysis of the sectors that matter most to investors, entrepreneurs, and anyone who wants to keep a finger on the market’s beat.

Manufacturing – Where Growth Meets Bottlenecks

India’s factories are churning out everything from auto parts to AI chips, but growth isn’t smooth. Data shows the sector’s output rose 4.8% YoY in Q2 2024, yet logistics costs remain a top headache. The main culprits? Limited rail capacity and high diesel prices. A practical fix many firms are testing is “hub‑and‑spoke” warehousing, which cuts last‑mile distance by 15‑20% on average. If you’re planning a new plant, locate it near a multimodal hub – you’ll save time and money right away.

Pharma & Food Processing – Speed, Scale, and Sustainability

Pharma continues to be India’s export hero, with the top 10 manufacturers accounting for 68% of global generic supplies. Their secret? Lean‑manufacturing coupled with aggressive patent‑expiry scouting. For food processors, the shift is toward ultra‑processed snack lines that meet global taste profiles while keeping a low carbon footprint. Investing in high‑efficiency dryers and recyclable packaging can boost margins by up to 12% without alienating eco‑conscious buyers.

Automotive insights are equally revealing. While electric‑vehicle (EV) assembly plants are sprouting in Gujarat and Tamil Nadu, the real driver of sales remains gasoline‑powered models – especially from Japanese makers that have tailored designs for Indian road conditions. If you’re a supplier, focus on components that can be used in both ICE and EV platforms; that flexibility makes you less vulnerable to policy swings.

Now, let’s talk data. A recent industry report highlighted three metrics that separate winners from laggards:

- Capacity utilization: firms above 75% consistently outpace peers in profit growth.

- R&D spend as % of revenue: a 5% investment yields a 1.8× return on new product launches.

- Supply‑chain resilience index: companies with diversified vendor bases recover 30% faster from disruptions.

Putting these numbers into practice is simpler than you think. Start with a quarterly review of your plant’s run‑rate, earmark a small budget for pilot‑testing new materials, and map out at least three alternative suppliers for every critical input.

Finally, keep an eye on policy shifts. The Production‑Linked Incentive (PLI) scheme is being extended to biotech and renewable‑energy equipment, which means new subsidies could lower capital costs by up to 18% over the next three years. Aligning your roadmap with these incentives can give you a competitive edge without extra cash outlay.

Ready to turn insight into action? Pick one of the three focus areas above, set a measurable goal for the next quarter, and watch the results stack up. The industry doesn’t wait – your next move could be the one that puts you ahead of the curve.

Top Manufacturing Businesses: Automotive and Electronics Industry Insights

- Aarav Sekhar

- Jul 21, 2025

Explore what makes automotive and electronics manufacturing the top global businesses, with real-world trends, stats, and useful tips for entrepreneurs and industry watchers.

Global Giants in Manufacturing: Leaders Shaping the Future

- Aarav Sekhar

- Feb 2, 2025

In the fast-evolving world of manufacturing, a few giants stand out, not only due to their sheer scale but also their ability to innovate and adapt. These companies are often influenced by government policies and schemes, which play a crucial role in shaping the landscape. This article explores the major players in the manufacturing sector, examining how they maintain their dominance and the impact of government interventions. From pioneering new technologies to adopting sustainable practices, these leaders are at the forefront of global manufacturing.