- US Manufacturing Rankings: Where Do They Stand? Mar 20, 2025

- Which chemicals are in most demand in India's manufacturing sector? Dec 19, 2025

- Biggest Steel Supplier in the US: Market Leaders, Facts, and Industry Tips Jul 30, 2025

- Who Still Dumps Garbage in the Ocean: The Role of Plastic Manufacturers Apr 3, 2025

- The Impact of Manufacturing on Local Economies and Societal Welfare Jan 21, 2025

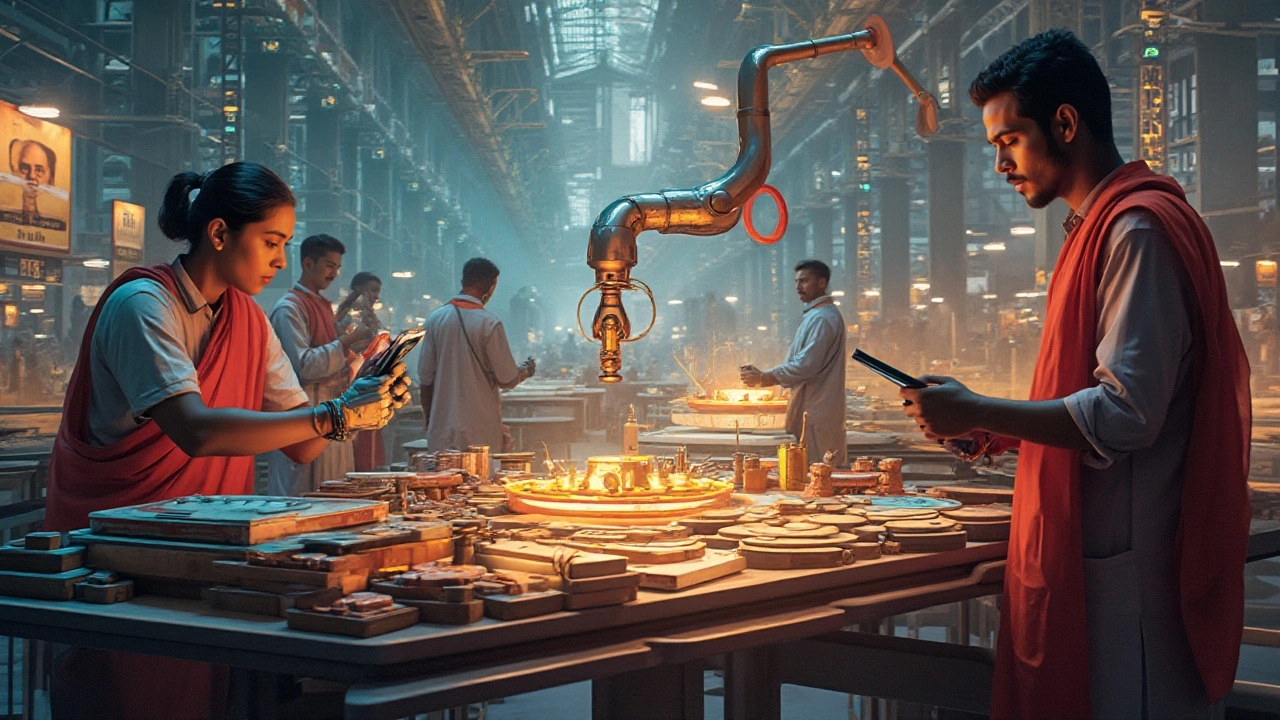

Government Schemes That Supercharge Indian Manufacturing

India’s factories are buzzing, but many businesses still wonder which government programs can actually help them grow. From tax breaks to credit guarantees, the government has rolled out a bunch of schemes that target everything from startups to large exporters. In this guide we’ll break down the most important ones, show how they fit together, and give you practical steps to start using them today.

Top Schemes You Should Know Right Now

Production Linked Incentive (PLI) – This is the headline program for sectors like electronics, medical devices, and automotive parts. The government pays a cash reward based on how many units you produce locally. If your plant meets the export or domestic sales targets, you get a percentage of the value back, which can dramatically improve cash flow.

MSME Credit Guarantee Fund – Small and medium enterprises often struggle to get loans because banks see them as risky. The credit guarantee fund steps in to cover a large part of the loan if the borrower defaults. That means banks are more willing to lend, and you can secure working capital at a lower interest rate.

Technology Upgradation Fund Scheme (TUFS) – Want to modernize your equipment but don’t have the money? TUFS offers subsidised loans for buying new machinery, especially for textile and leather units. The subsidy can go up to 15% of the project cost, making high‑tech upgrades affordable.

How to Tap Into These Programs – A Simple Checklist

1. Identify the right scheme. Look at your product line and growth goals. If you’re exporting electronics, PLI is likely the best fit. If you run a small leather workshop, TUFS might be more relevant.

2. Gather the required documents. Most programs need a GST registration, audited financials, and a detailed production plan. Keep everything digital to speed up the application.

3. Register on the official portal. The Government of India’s ‘Ease of Doing Business’ portal lets you create an account, upload docs, and track status in real time.

4. Engage a consultant if needed. A short session with a local advisor can clarify eligibility and avoid common mistakes that delay approval.

5. Follow up regularly. Approval can take weeks, so stay in touch with the officer handling your case. A polite email every few days keeps your file on the radar.

By following these steps you can turn a confusing maze of paperwork into a straight line toward funding.

Remember, these schemes aren’t one‑size‑fits‑all. The key is to match the incentive to your specific bottleneck – be it finance, technology, or market access. When you align the right program with the right need, the impact is immediate: lower costs, higher output, and a stronger competitive edge.

Ready to start? Grab your latest balance sheet, log onto the portal, and see which incentive matches your business. The government’s money is waiting – you just have to claim it.

Best State to Build a Factory: Manufacturing Success by Location

- Aarav Sekhar

- May 14, 2025

Wondering where to build your next factory? This article breaks down which state is the best for manufacturing based on real government schemes, costs, and future growth. It explains the key things to consider before breaking ground. You'll learn practical tips, state-by-state perks, and how to make the government work for your business. Get ready for actionable info, not guesswork.

How Manufacturing Shapes Our Lives: Insights from Government Schemes

- Aarav Sekhar

- Apr 7, 2025

Manufacturing has a massive influence on our everyday lives, affecting everything from the economy to our daily routines. With government schemes aiming to boost and modernize the sector, understanding these impacts can be more relevant than ever. This article digs into the intersection of manufacturing and living standards, shedding light on how policies shape both industries and individuals' experiences.

Global Giants in Manufacturing: Leaders Shaping the Future

- Aarav Sekhar

- Feb 2, 2025

In the fast-evolving world of manufacturing, a few giants stand out, not only due to their sheer scale but also their ability to innovate and adapt. These companies are often influenced by government policies and schemes, which play a crucial role in shaping the landscape. This article explores the major players in the manufacturing sector, examining how they maintain their dominance and the impact of government interventions. From pioneering new technologies to adopting sustainable practices, these leaders are at the forefront of global manufacturing.

The Impact of Manufacturing on Local Economies and Societal Welfare

- Aarav Sekhar

- Jan 21, 2025

Manufacturing plays a pivotal role in fueling local economies and enhancing the welfare of societies. This article explores how manufacturing sectors can transform communities with job creation, increased tax revenue, and skill development. It examines the influence of government schemes in supporting the industry and the ripple effects on both economic growth and social well-being. Learn about the tangible benefits and how strategic investments in manufacturing can uplift communities.

Understanding Manufacturing's Place in Government Schemes

- Aarav Sekhar

- Dec 2, 2024

Manufacturing plays a pivotal role in the economy and its administrative placement within government departments can have significant impacts on policy development and implementation. This article explores which government department typically oversees manufacturing, the reasons behind its placement, and how policies are crafted to support this critical sector. It also discusses the influence of recent technological advancements and global dynamics on manufacturing regulations. By delving into these aspects, readers gain insights into how governmental structures can enhance manufacturing's growth and innovation.