- Is AbbVie owned by Abbott? - Unraveling the corporate link between two pharma giants Oct 20, 2025

- Highest Earning Businesses in a Day: Where the Biggest Daily Profits Happen Jul 13, 2025

- India's Electronics Hub: Exploring the Capital of Innovation Apr 10, 2025

- Which City Is Called the City of Textile? The Real Story Behind India’s Textile Capital Feb 20, 2026

- How to Sell an Idea Without a Patent: Real Ways to Protect and Profit from Your Manufacturing Concept Feb 13, 2026

Corporate Relationship: Partnerships, Alliances & Joint Ventures

When working with Corporate relationship, the ongoing interaction between two or more companies that share goals, resources, or market interests. Also known as company partnership, it drives growth, innovation, and risk sharing. Key forms include business partnerships, strategic alliances, joint ventures and supplier relationships, each with its own rules and benefits.

Business Partnerships: Shared Resources, Shared Success

Business partnerships are informal or formal agreements where companies pool assets to reach a common market goal. Typical attributes include co‑marketing, product bundling, and profit‑sharing. For example, a tech firm might pair its software with a hardware maker’s devices to create a bundled solution that neither could sell as effectively alone. The partnership thrives on clear communication, joint planning, and mutual trust. When both sides align their sales pipelines, the partnership can double revenue streams without needing a new legal entity.

Strategic alliances go a step further by linking firms that retain independence but collaborate on a focused initiative such as R&D, standards development, or market entry. These alliances often require governance boards, shared IP policies, and performance metrics. A classic case is two automotive manufacturers teaming up to develop electric‑vehicle platforms while still competing in other segments. The alliance’s success hinges on transparent decision‑making and a balanced risk‑reward structure.

Joint ventures create a brand‑new legal entity owned by the partners, combining capital, expertise, and risk. Attributes include a separate board, defined equity stakes, and a joint business plan. A joint venture can unlock markets that are otherwise inaccessible—think of a foreign electronics company partnering with an Indian firm to produce AI chips locally, leveraging domestic incentives and supply chains. Because a JV operates as its own company, it demands rigorous financial reporting, compliance, and a clear exit strategy.

Supplier relationships are the backbone of any manufacturing ecosystem. Strong ties with suppliers ensure stable input quality, on‑time delivery, and cost predictability. Key attributes involve long‑term contracts, collaborative forecasting, and joint improvement programs. When a car maker works closely with its steel supplier to develop high‑strength alloys, both benefit from reduced waste and faster time‑to‑market. Trust and data sharing turn a simple buyer‑seller link into a strategic advantage.

Understanding how Corporate relationship dynamics intersect with manufacturing trends helps leaders spot opportunities. The posts below reveal why Shenzhen claims the title of the world’s manufacturing capital, how BASF remains the top chemical producer, and which U.S. sectors enjoy the highest profit margins. Each article illustrates how effective partnerships, alliances, joint ventures, or supplier ties can amplify a company’s competitive edge. You’ll see real‑world metrics, case studies, and actionable insights that tie back to the relationship types discussed here.

Now that you’ve got a clear picture of the main relationship models, the list that follows will dive deeper into specific industries, market leaders, and emerging opportunities. From pharma plants in India to AI chip makers, each entry shows how the right corporate relationship can translate into growth, resilience, and market leadership.

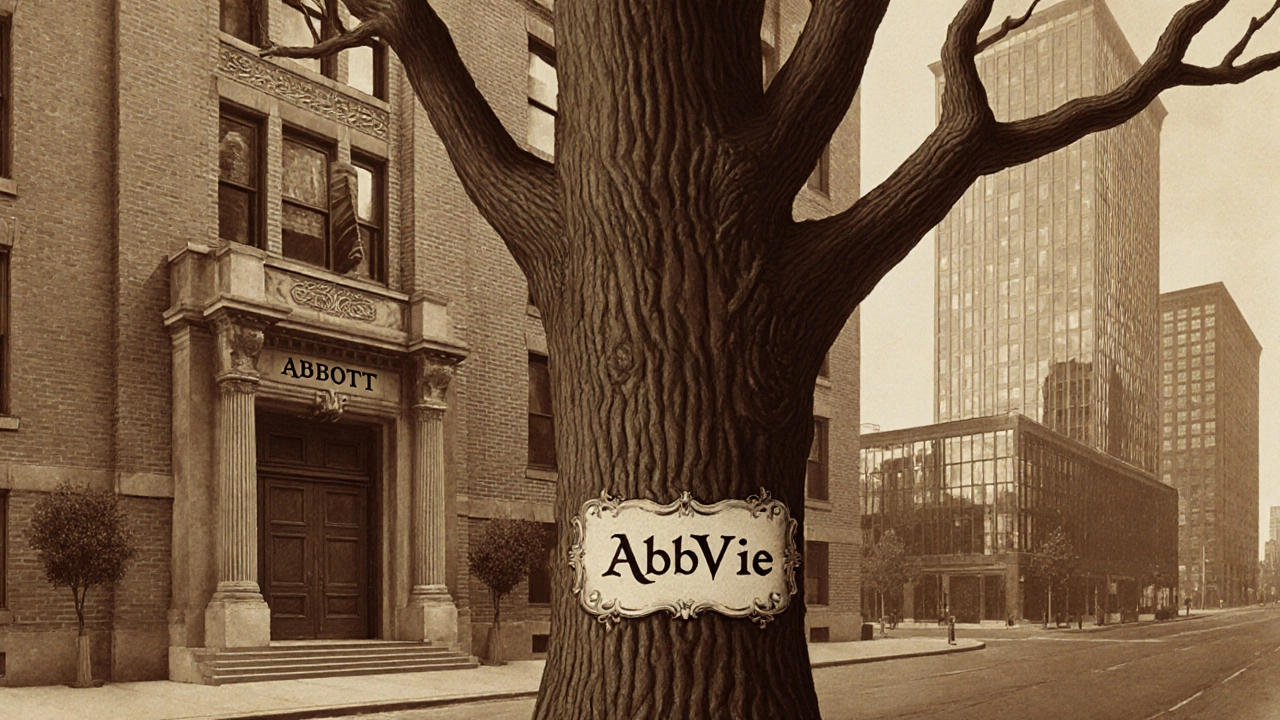

Is AbbVie owned by Abbott? - Unraveling the corporate link between two pharma giants

- Aarav Sekhar

- Oct 20, 2025

Clear up the confusion: AbbVie spun off from Abbott in 2013 and is now an independent company. Learn the ownership facts, financials, and how both operate in India.