AbbVie vs Abbott Comparison Tool

Key Facts

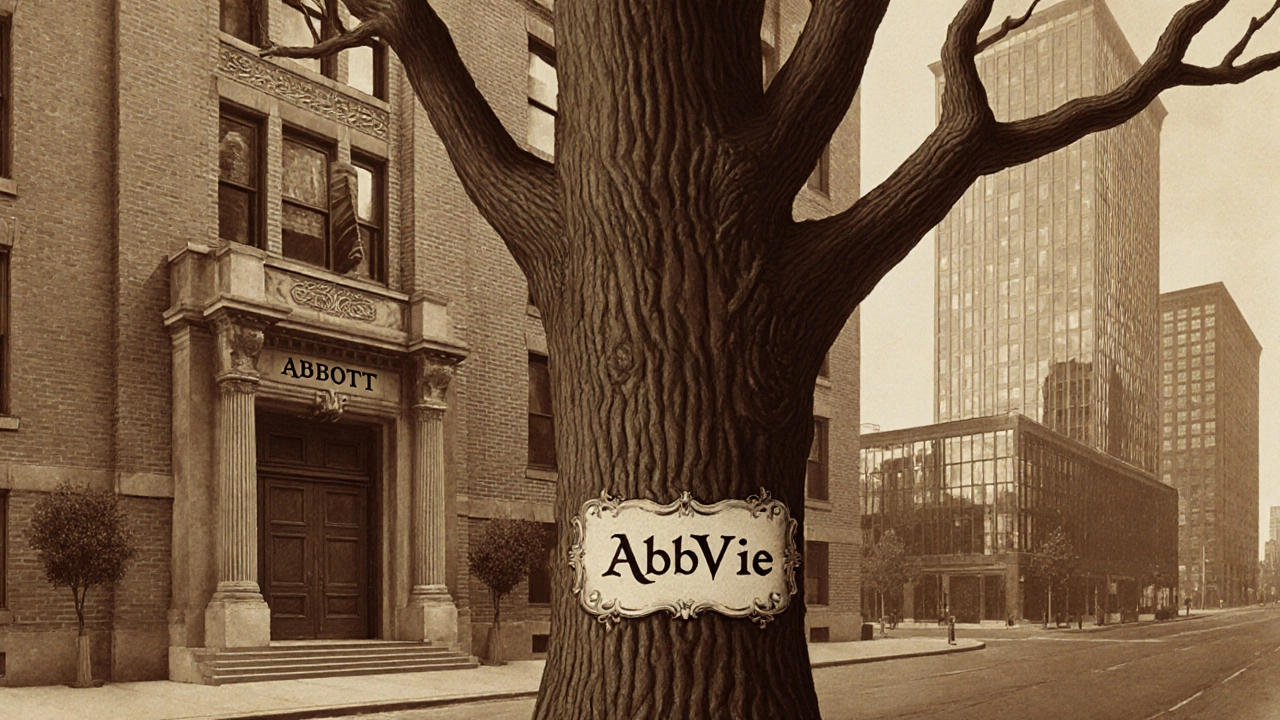

When people hear “AbbVie” they often wonder if it’s a subsidiary of “Abbott”. AbbVie is a global biopharmaceutical company that was spun off from Abbott Laboratories in 2013. The split created two independent, publicly‑traded firms that now operate side by side but answer to different boards, shareholders, and market strategies.

Key Takeaways

- AbbVie and Abbott are separate companies; AbbVie is not owned by Abbott.

- AbbVie became independent in 2013 after a spinoff that gave it its own stock ticker (ABBV) on the NYSE.

- Both firms trace their roots to the original Abbott entity founded in 1888, but they now focus on distinct product portfolios.

- Ownership structures: Abbott is held by a diversified shareholder base; AbbVie’s major shareholders include institutional investors like Vanguard and BlackRock.

- The Indian market sees both brands operating through separate subsidiaries and joint‑venture arrangements.

How the Abbott‑AbbVie split happened

Abbott Laboratories started as a Chicago‑based medical‑device firm in the late 19th century. By the early 2000s the company had grown into a sprawling conglomerate covering diagnostics, nutrition, medical devices, and branded pharmaceuticals. Management decided that the pharmaceutical arm would create more value as a stand‑alone business. In January 2013 the board announced a spin‑off-a corporate maneuver where shareholders receive shares of the new company while retaining their original Abbott holdings.

The transaction closed on July 1 2013. Abbott shareholders were issued one AbbVie share for every five Abbott shares they owned. AbbVie launched on the New York Stock Exchange under the ticker “ABBV”, while Abbott kept the ticker “ABT”. Both firms filed separate 10‑K reports with the SEC, confirming distinct financial statements and governance.

Current ownership and governance

Since the split, neither company holds a controlling stake in the other. AbbVie’s board is chaired by Richard A. Miller, while Abbott’s board is led by Robert B. Miller (no relation). The two sets of directors meet independently, and their compensation committees operate under separate policies.

Major institutional investors dominate both shareholder bases. As of the latest filings (Q2 2025), the top five holders of AbbVie stock are Vanguard Group (7.5 %), BlackRock (6.9 %), State Street (4.8 %), Capital Research (3.1 %), and Fidelity (2.7 %). Abbott’s top holders are similar: Vanguard (8.2 %), BlackRock (7.4 %), State Street (5.1 %), Capital Research (3.3 %), and Fidelity (2.9 %). The overlap reflects the broader market’s confidence in large‑cap pharma, not a parent‑subsidiary link.

Product portfolios: where the two diverge

AbbVie’s focus is on high‑margin biologics and specialty drugs. Its blockbuster products include Humira (adalimumab), Imbruvica (ibrutinib), and newer entrants like Skyrizi (risankizumab) for psoriasis. The company’s R&D pipeline leans heavily into immunology, oncology, and virology.

Abbott, on the other hand, has a broader mix: diagnostics (e.g., Alinity systems), nutrition (e.g., Similac), medical devices (e.g., cardiac rhythm management), and a smaller pharmaceutical segment focused on generic and branded medicines. Abbott’s flagship pharma drugs include Darzalex (multiple myeloma) and a line of cardiovascular agents.

In India, AbbVie operates through AbbVie India Private Limited, focusing on biologics and specialty injectables, while Abbott runs Abbott India Ltd., which is a leader in nutrition and diagnostics. The two companies often compete for the same hospital contracts but never under a single corporate umbrella.

Financial snapshot (FY 2024)

| Metric | AbbVie (ABBV) | Abbott (ABT) |

|---|---|---|

| Revenue (USD bn) | 58.9 | 45.2 |

| Net Income (USD bn) | 12.1 | 5.4 |

| Employees | 48,000 | 107,000 |

| Stock Exchange | NYSE (ABBV) | NYSE (ABT) |

| Market Cap (USD bn) | 215 | 190 |

The numbers underline how AbbVie’s earnings are driven by a few high‑priced biologics, while Abbott’s broader portfolio spreads risk across multiple segments.

Regulatory and legal landscape

Both companies are regulated by the U.S. Food and Drug Administration (FDA) and must comply with the Indian Central Drugs Standard Control Organization (CDSCO) for operations in India. There have been isolated legal disputes-most notably AbbVie’s patent battles over Humira-but none involve a claim of ownership by Abbott.

In 2020, the Indian Competition Commission cleared a joint venture between AbbVie and a local contract manufacturer, confirming that no anti‑competitive ties existed between AbbVie and Abbott.

Common misconceptions and why they persist

- Name similarity: The “Abb” prefix makes people assume a parent‑subsidiary link, especially when both firms appear together in pharma conferences.

- Historical roots: Both trace lineage back to the 1888 Abbott founding, so older industry veterans sometimes refer to them as “the Abbott family”.

- Shared branding in some markets: In certain countries, joint marketing agreements have led to co‑branded promotional material, further blurring the lines for observers.

Understanding the corporate genealogy clears up these myths: AbbVie is fully independent, with its own board, stock, and strategic roadmap.

Implications for investors and job seekers

Investors treat AbbVie and Abbott as separate equities. Portfolio diversification strategies often allocate to both to capture AbbVie’s high‑margin biologics exposure and Abbott’s steady cash flow from diagnostics and nutrition. For job seekers, each company runs distinct recruitment portals and talent programs; applying to one does not imply a gateway to the other.

What this means for the Indian pharma scene

India’s market, worth over $50 billion, hosts both firms through independent subsidiaries. AbbVie focuses on premium biologics for urban hospitals, while Abbott leverages its strong distribution network for nutrition and diagnostics across rural areas. The competition drives innovation, but the two entities remain legal rivals, not branches of the same tree.

Quick FAQ

Is AbbVie a subsidiary of Abbott?

No. AbbVie became an independent public company in 2013 after a spin‑off from Abbott.

Do AbbVie and Abbott share any ownership?

They share many of the same institutional investors, but neither holds equity in the other.

Which stock ticker represents AbbVie?

AbbVie trades on the New York Stock Exchange under the symbol “ABBV”.

Are there any joint ventures between AbbVie and Abbott?

There are no joint ventures linking the two companies. Any collaborations occur with third‑party firms, not directly between AbbVie and Abbott.

How does the Indian market treat the two brands?

In India, AbbVie and Abbott operate through separate subsidiaries, each with its own product focus and salesforce.

Bottom line

If you’ve been wondering whether AbbVie is owned by Abbott, the short answer is a clear no. The two are independent, publicly‑traded pharma giants that share a historic parent but now walk their own paths. Knowing this helps investors, patients, and professionals make informed decisions without the confusion of a myth that’s persisted for years.