- Export Garments from India to USA: 2025 Step‑by‑Step Guide Oct 24, 2025

- Which Country Is Most Advanced in Electronics Manufacturing? Dec 16, 2025

- Where Does CVS Get Their Drugs From? Inside the Pharma Manufacturer Pipeline Apr 27, 2025

- What is .0005 called in food processing units? Mar 4, 2026

- Who Dominates the Electronics Manufacturing Industry Today? Jan 13, 2025

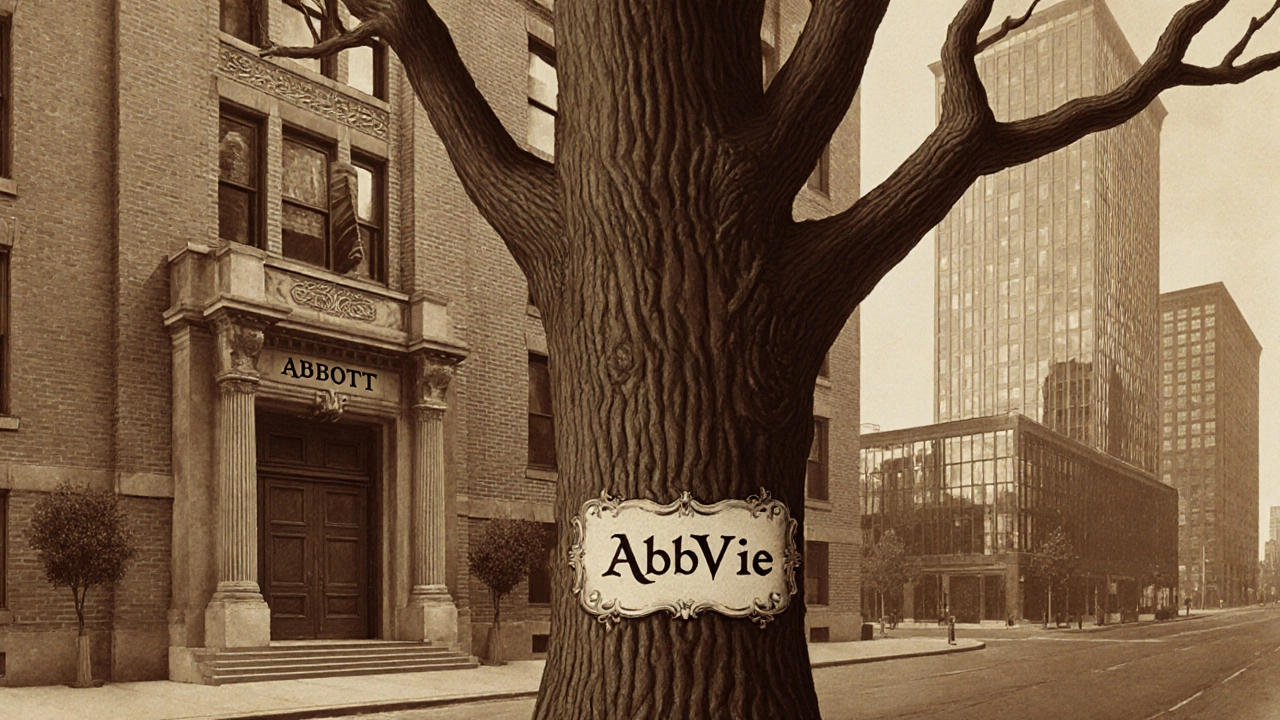

AbbVie Ownership: Who Controls the Pharma Giant?

When looking at AbbVie ownership, the distribution of shares and control mechanisms of the global biopharma firm. Also known as AbbVie shareholding, it reveals who steers the company's direction. The primary holder, AbbVie, a leading biopharmaceutical corporation, operates within the broader pharmaceutical industry, which is driven by research pipelines, regulatory bodies, and market demand. Meanwhile, the stock market reflects investor sentiment and influences corporate governance.

The AbbVie ownership landscape is defined by three main forces. First, major shareholders—including institutional investors and mutual funds—hold the bulk of voting power, shaping strategic decisions. Second, corporate governance policies require compliance with the U.S. Securities and Exchange Commission, ensuring transparency and protecting minority investors. Third, industry trends such as M&A activity, biotech collaborations, and FDA approvals directly impact share valuation and ownership stakes. For example, a successful drug launch can trigger a surge in the stock price, prompting activist investors to push for board changes. Conversely, a regulatory setback may lead existing shareholders to reduce exposure, shifting the balance of power. These dynamics illustrate how AbbVie ownership intertwines with market performance, research outcomes, and legal frameworks.

Below you’ll find a curated set of articles that dive deeper into each of these areas— from the top shareholders driving decisions, to how the pharma sector’s regulatory environment shapes ownership structures, and what recent M&A moves mean for future control. Use this collection to get a clear picture of who holds the reins at AbbVie and how those forces might evolve in the coming years.

Is AbbVie owned by Abbott? - Unraveling the corporate link between two pharma giants

- Aarav Sekhar

- Oct 20, 2025

Clear up the confusion: AbbVie spun off from Abbott in 2013 and is now an independent company. Learn the ownership facts, financials, and how both operate in India.