Furniture Revenue Calculator

Compare Furniture Company Revenue

See the massive difference between IKEA's global scale and leading Indian manufacturers.

Revenue Comparison

IKEA's annual revenue is 97x larger than the maximum revenue of any Indian furniture company.

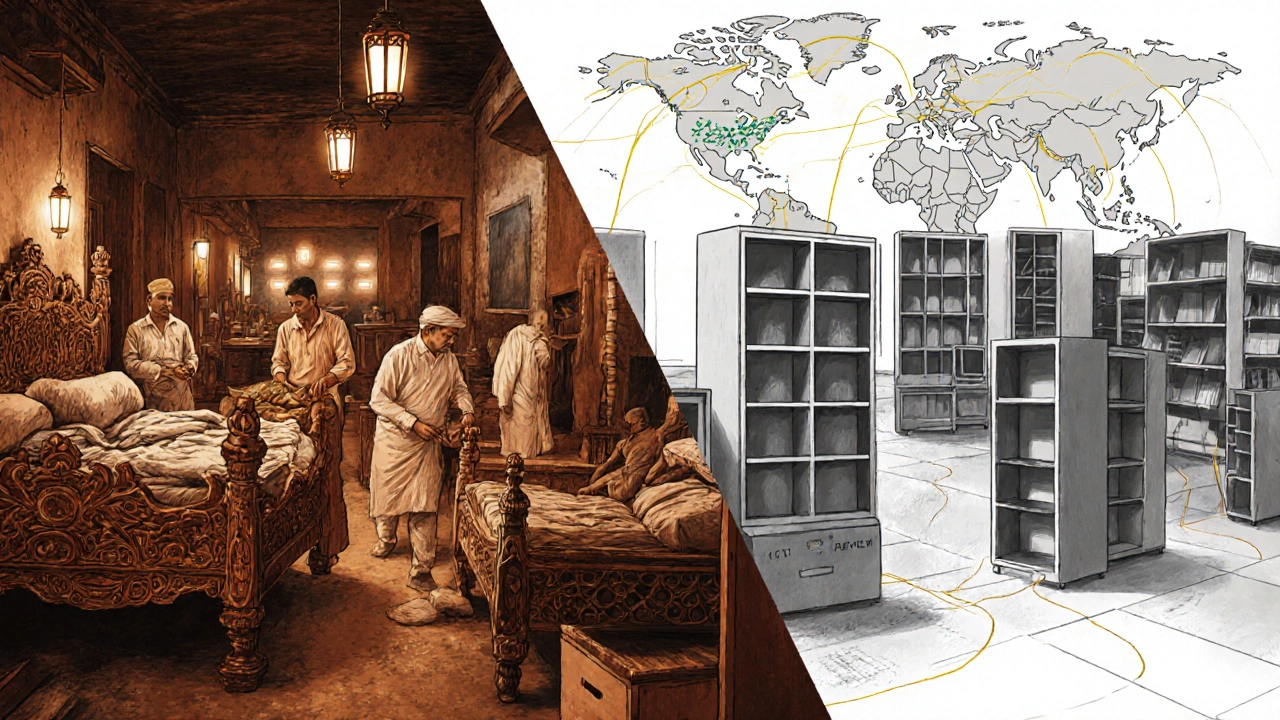

The richest furniture company in the world isn’t based in Italy, Germany, or even the United States. It’s a Swedish brand that sells flat-pack shelves and sofas in over 60 countries, with annual sales exceeding $48 billion. That company is IKEA. While India has a booming furniture manufacturing sector-especially in cities like Moradabad, Panipat, and Tirupur-it doesn’t yet have a single company that rivals IKEA’s scale, profitability, or global reach.

How IKEA Became the World’s Largest Furniture Company

IKEA started in 1943 as a small mail-order business selling pens, wallets, and picture frames. By the 1950s, founder Ingvar Kamprad began adding furniture, and by the 1970s, the flat-pack model was perfected. The genius wasn’t just in the design-it was in the business model. Customers paid less because they assembled the furniture themselves. IKEA saved on labor, warehousing, and delivery costs. Today, it operates more than 450 stores worldwide and has over 200,000 employees.

In 2024, IKEA reported $48.6 billion in revenue, more than the next five largest furniture companies combined. Its profit margin hovers around 12%, which is unusually high for a retail brand selling low-cost goods. How? Vertical integration. IKEA owns forests in Romania and Poland, controls its own logistics through its subsidiary DHL partner, and even manufactures its own fabrics and foam. It doesn’t just sell furniture-it controls the entire supply chain from tree to doorstep.

How Indian Furniture Manufacturers Compare

India’s furniture industry is growing fast. The market is worth over $18 billion in 2025 and is expected to hit $30 billion by 2030. Cities like Moradabad, known for brass and wood carvings, and Panipat, famous for upholstered furniture, produce millions of pieces annually. Companies like Durian, Woodside, and Urban Ladder are leading the domestic market.

But here’s the catch: no Indian furniture company makes more than $500 million in annual revenue. Urban Ladder, once the most valuable Indian furniture startup, was acquired by Reliance Retail in 2021 for $120 million. Even after the acquisition, its revenue remains under $400 million. Compare that to IKEA’s $48 billion. Indian firms focus on local demand, handmade craftsmanship, and small-scale production. They don’t have the capital to build global warehouses, invest in automated factories, or run multilingual marketing campaigns.

Why Scale Matters More Than Craftsmanship

Many assume that hand-carved Indian teakwood beds or brass-inlaid cabinets are more valuable than a flat-pack Billy bookcase. That’s true in terms of artistry-but not in terms of business. IKEA sells 14 million Billy bookcases every year. That’s more than the entire annual output of India’s furniture sector. One product. One design. One supply chain.

Indian manufacturers often struggle with consistency. A bed made in Delhi might have different dimensions than one made in Jaipur. IKEA’s designs are standardized down to the millimeter. Every screw, hinge, and panel is made in the same factory with the same machines. That’s why they can ship a 20-foot container full of identical bookshelves to a store in Nairobi, Jakarta, or Toronto.

India’s strength lies in customization and artisanal quality. But that’s a niche. IKEA’s strength is volume. It’s not about making one perfect chair. It’s about making 10 million good enough chairs that people love because they’re affordable, modern, and easy to move.

Other Global Giants in the Furniture Game

While IKEA leads, it’s not alone. Here are the other top players:

- Williams-Sonoma (USA): Owns Pottery Barn, West Elm, and Williams-Sonoma brands. Generates $7.8 billion in revenue, focused on premium U.S. and Canadian markets.

- Ashley Furniture (USA): The largest furniture manufacturer in the U.S. with $5.5 billion in revenue. Makes everything from recliners to bedroom sets in its own factories across Wisconsin and China.

- Steelcase (USA): The biggest office furniture company, with $4.2 billion in sales. Serves Fortune 500 companies.

- Flexsteel (USA): Known for durable sofas and recliners. Revenue: $1.1 billion.

- BoConcept (Denmark): Premium modern design. Revenue: $850 million.

None of these companies come close to IKEA’s revenue. And none have the same global footprint. Ashley Furniture sells mostly in North America. Williams-Sonoma targets middle- to upper-income households. IKEA sells to students, young families, retirees, and renters-all at once.

What’s Holding Indian Furniture Companies Back?

There are three big barriers:

- Access to capital: Starting a furniture factory in India costs $500,000 to $2 million. Most owners fund it through family savings or local banks with high interest. IKEA’s parent company, Ingka Group, has over $10 billion in cash reserves.

- Supply chain fragmentation: Wood comes from one state, fabric from another, screws from a third. IKEA sources everything through its own network of 1,700 suppliers, all audited and standardized.

- Lack of branding: Indian consumers don’t buy ‘Urban Ladder’-they buy ‘a bed for ₹25,000.’ IKEA sells a lifestyle. Their catalog isn’t just a price list-it’s a magazine with photos of real people living in real homes.

Some Indian companies are trying to change. Pepperfry, for example, uses AI to suggest furniture layouts based on room photos. Urban Ladder used to offer free interior design consultations. But these are tactical moves, not strategic overhauls.

Can an Indian Company Ever Become the Richest?

It’s possible-but not soon. For an Indian company to surpass IKEA, it would need to:

- Build factories in at least 10 countries

- Develop a global logistics network

- Invest $5 billion+ in R&D and automation

- Create a brand that resonates from Brazil to Bangladesh

No Indian company is even close to that level of ambition or funding. The government’s PLI scheme for furniture manufacturing offers subsidies of up to 15% on capital investment-but that’s a drop in the ocean compared to what IKEA spends annually on logistics alone.

India’s future in furniture isn’t about becoming the richest. It’s about becoming the most diverse. While IKEA sells 10 million identical bookcases, India can sell 10 million unique ones. That’s a different kind of power.

What You Should Know Before Buying Furniture

Whether you’re shopping in Bangalore or Birmingham, here’s what actually matters:

- Material: Solid wood lasts longer than particleboard. Check for wood type-teak, sheesham, or oak are durable.

- Joinery: Dovetail joints are stronger than nails or glue. Ask how the drawers are made.

- Warranty: IKEA offers 10 years on most products. Indian brands typically offer 1-3 years.

- Delivery: Flat-pack means you assemble it yourself. Full assembly costs extra. Factor that in.

- Return policy: Can you return it if it doesn’t fit? IKEA allows returns within 365 days. Most Indian retailers don’t.

Don’t just buy based on price. Buy based on how long it’ll last-and how easy it’ll be to replace if something breaks.

Is IKEA really the richest furniture company in the world?

Yes. As of 2025, IKEA is the world’s largest furniture company by revenue, with over $48 billion in annual sales. It’s more than twice the size of its nearest competitor, Ashley Furniture, and more than 100 times larger than the biggest Indian furniture brand.

Which Indian company makes the most furniture?

There isn’t one dominant Indian company. Pepperfry and Urban Ladder are the largest online retailers, but they don’t manufacture most of their products-they outsource to hundreds of small workshops. In terms of manufacturing, companies like Durian and Godrej Interio lead in volume, but none generate over $500 million in revenue.

Why doesn’t India have a global furniture giant like IKEA?

India’s furniture industry is fragmented. Most manufacturers are small workshops with limited capital. They focus on local demand, handmade products, and traditional designs. Building a global brand requires massive investment in automation, logistics, marketing, and standardization-something few Indian firms have the resources or vision to do.

Are Indian-made furniture products better than IKEA’s?

It depends on what you value. Indian furniture often uses solid wood, hand-carving, and traditional craftsmanship, making it more durable and unique. IKEA uses engineered wood and mass production, which makes it cheaper, more consistent, and easier to replace. Neither is universally better-it’s about your needs: longevity vs. affordability, artistry vs. convenience.

Where does IKEA get its wood from?

IKEA sources wood from responsibly managed forests in Sweden, Poland, Romania, and Russia. It’s certified by the Forest Stewardship Council (FSC). It also uses recycled wood and bamboo in many products. The company has strict rules against using wood from illegally logged areas.

Can Indian furniture companies compete with IKEA on price?

Not directly. IKEA’s scale lets it buy materials in bulk, automate production, and cut out middlemen. An Indian workshop making a similar bookshelf by hand can’t match that cost. But Indian brands can compete on design, customization, and cultural relevance-offering pieces that fit Indian homes better than a Swedish flat-pack shelf.