- Discovering 3 Essential Types of ROM in Food Processing Mar 5, 2025

- India Manufacturing: Key Industries and What the Country Mainly Produces Sep 25, 2025

- Fully Made-in-India Cars: Which Models Are 100% Manufactured Locally? Oct 16, 2025

- Top Small Scale Manufacturing Business Trends in 2024 Dec 4, 2024

- Why Do Indian People Drive Toyotas? Car Trends Demystified Jun 9, 2025

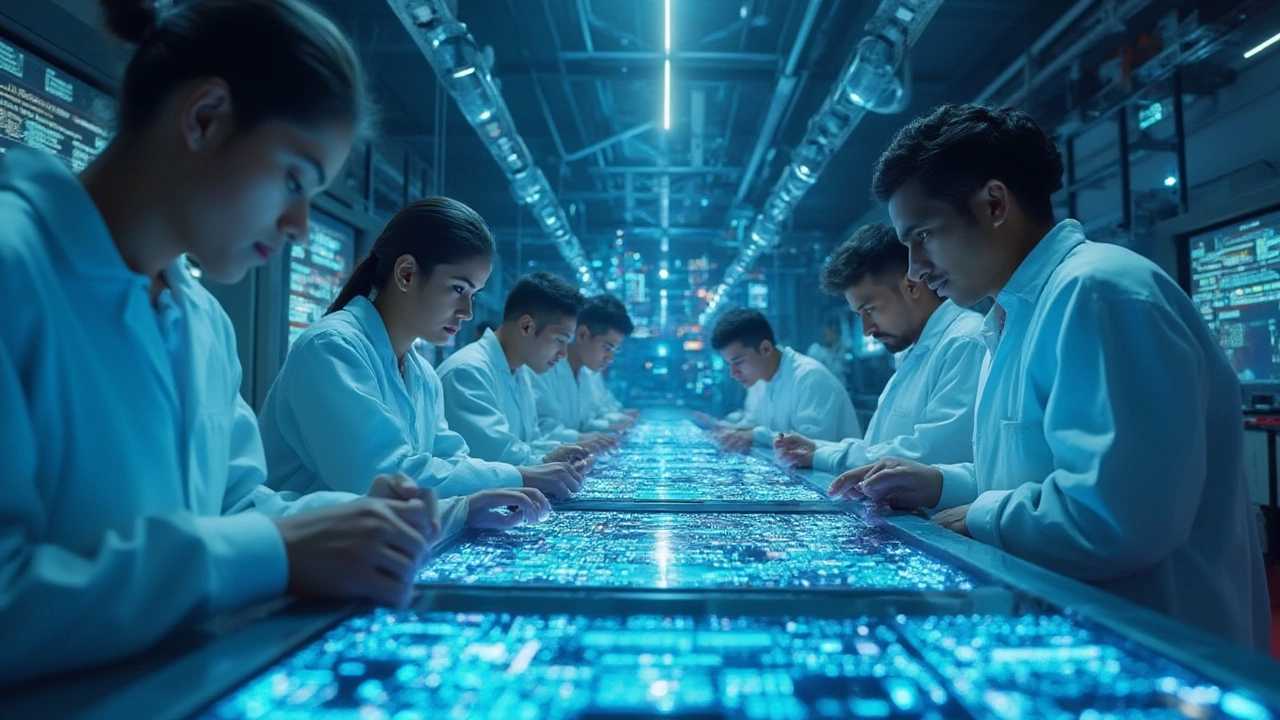

AI Chips in India: What’s Happening and What to Expect

India is stepping up its game in AI hardware. While most people think of smartphones and software, the real engine behind today’s smart apps is the AI chip. These tiny processors crunch massive data sets in seconds, making everything from voice assistants to industrial robots possible. If you’re wondering whether India can produce these chips locally, the answer is a big yes – and it’s happening faster than many expect.

Who’s Building AI Chips in India?

Several Indian firms are now designing and fabricating AI‑focused semiconductors. Companies like Hindustan Semiconductor and Elara Tech have rolled out edge‑AI chips that work in factories and farms. They partner with global foundries such as TSMC and GlobalFoundries for the actual silicon manufacturing, but the design work stays in India. Start‑ups are also entering the space – Krishna AI and DeepChip focus on low‑power chips for IoT devices, which is a huge market for the country’s agricultural sector.

Government programs are giving these players a boost. The PLI (Production Linked Incentive) scheme now includes a line for AI semiconductor production, offering cash incentives and tax breaks. This means more money for R&D and a faster path from prototype to mass production.

Why the Push for Domestic AI Chips?

Relying on imports creates supply bottlenecks, especially when global chip shortages hit. By building chips at home, Indian companies can keep critical AI systems running without waiting months for shipments. This is a big win for sectors like healthcare, where AI‑driven imaging tools need fast, reliable hardware.

Local production also cuts costs. Import duties, shipping, and currency swings add up. When you design and assemble chips in India, you shave off a significant portion of the price, making AI solutions more affordable for small businesses.

Lastly, having a domestic AI chip ecosystem fuels talent growth. Engineers who train on cutting‑edge design tools stay in the country, creating a virtuous cycle of innovation and job creation.

Market Outlook: Where Is the Growth Heading?

Analysts predict the Indian AI chip market will grow at double‑digit rates through 2028. The biggest drivers are edge computing in manufacturing, smart agriculture, and 5G‑enabled devices. Companies are already signing deals to embed AI chips in tractors, pesticide sprayers, and factory robots.

Export potential is another bright spot. Neighboring countries in South Asia and Southeast Asia are looking for affordable AI hardware, and India’s cost advantage positions it well to become a regional supplier.

Challenges remain, though. Scaling up fabrication capacity takes time and massive investment. India still relies heavily on overseas foundries for the most advanced nodes (7 nm and below). However, the government’s focus on building a silicon valley‑style ecosystem means new fabs could be on the horizon within the next few years.

For anyone interested in the AI chip space – whether you’re a startup founder, an investor, or a tech enthusiast – keep an eye on the policy updates and the emerging player list. Those who move early can snag partnerships, funding, and market share before the field gets crowded.

Bottom line: AI chips are no longer a foreign specialty. India is building the talent, the design houses, and the policy support to make home‑grown AI hardware a reality. The next wave of smart devices made in India will likely run on chips that were designed right here, and that shift could reshape the whole tech landscape in the country.

AI Chip Manufacturing in India: Who Makes Them and What's Next?

- Aarav Sekhar

- Jul 28, 2025

Discover which companies are making AI chips in India, how India is building its semiconductor industry, and what it means for AI-driven innovation.