Textile Hub Comparison Tool

Surat

Gujarat's textile powerhouse

Ahmedabad

Cotton hub of Gujarat

Coimbatore

Tamil Nadu's weaving center

Tirupur

Knitwear capital of India

Key Performance Metrics

Employment

Surat employs 2.2 million workers in textile sector

Ahmedabad: 1.6 million

Coimbatore: 1.3 million

Tirupur: 0.9 million

Export Contribution

Surat contributes 20% of India's textile exports

Ahmedabad: 13%

Coimbatore: 9%

Tirupur: 8%

Surat's Competitive Advantages

- 1 Focus on synthetic fabrics (30% of national output)

- 2 Strong infrastructure with reliable power supply

- 3 Proximity to Hazira Port for efficient exports

- 4 Government incentives under Gujarat Textile Policy 2022

- 5 Large skilled labor pool from regional vocational institutes

Quick Facts

- Surat (Gujarat) generates over $10billion in annual textile turnover.

- It employs more than 2million workers in the textile and garment sector.

- Surat accounts for ~30% of India's synthetic fabric output.

- Exports from Surat make up roughly 20% of India's total textile export value.

- Key rivals are Ahmedabad, Coimbatore and Tirupur, but none match Surat’s scale.

When it comes to the textile industry city India, Surat stands out as the clear leader. The city’s blend of modern mills, a massive skilled workforce, and proactive state policies gives it a decisive edge over traditional hubs like Ahmedabad or emerging centers such as Coimbatore.

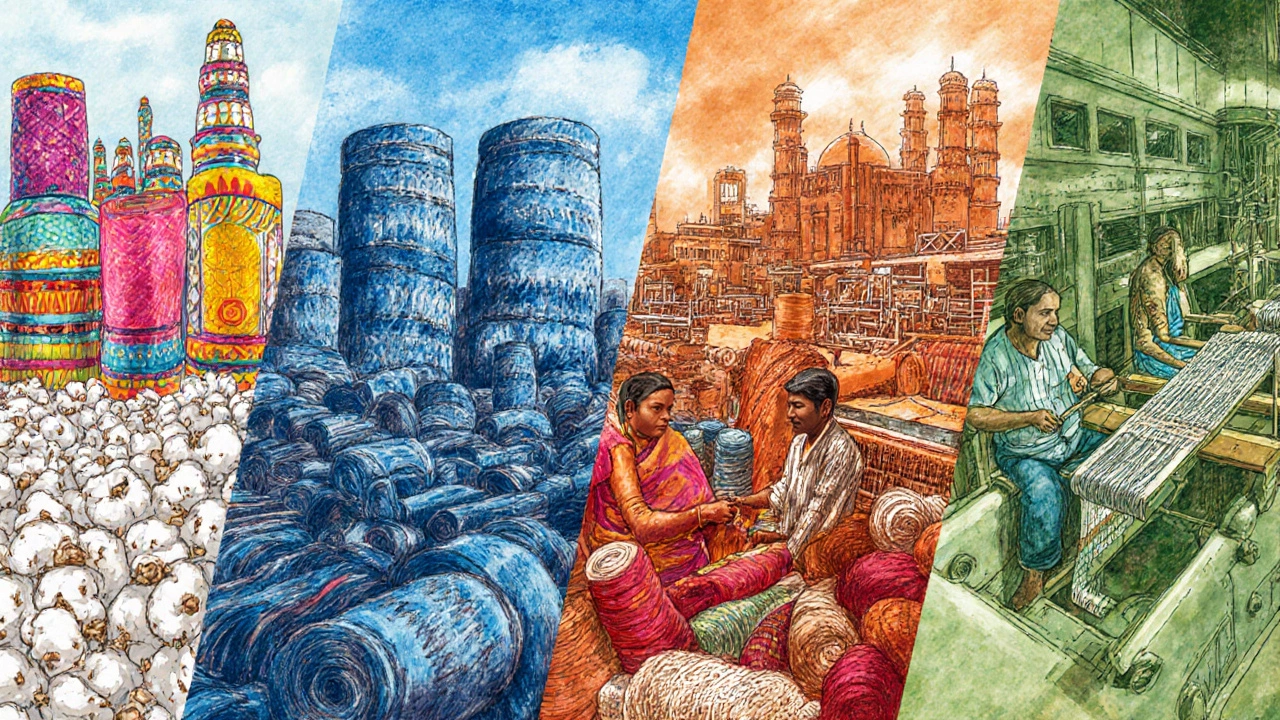

India’s Textile Landscape at a Glance

India ranks among the top three textile producers globally, contributing about 2% of the world’s total textile output. The sector employs roughly 45million people and accounts for 13% of the nation’s export earnings. Major clusters are spread across Gujarat, Maharashtra, TamilNadu, Karnataka and WestBengal, each specializing in a mix of cotton, synthetic, and technical fabrics.

Surat - The Powerhouse of Synthetic Fabrics

Surat is a coastal city in Gujarat that has transformed from a diamond‑cutting hub into the world’s largest producer of synthetic yarn and fabrics. According to the Gujarat Industrial Development Corporation, the city houses more than 7,500 textile units, ranging from small family‑run workshops to multi‑billion‑dollar integrated mills.

Key statistics (2023‑24):

- Annual textile turnover: $10.4billion

- Employment in textile sector: 2.2million

- Export value: $3.1billion (≈20% of India’s total)

- Dominant products: Viscose, polyester, blended fabrics, printed garments

Surat’s growth is driven by three forces: abundant power supply, a well‑developed logistics network (including the nearby Hazira Port), and a supportive state government that offers tax incentives and skill‑development schemes.

How Surat Stacks Up Against Other Major Textile Cities

| City | State | Annual Turnover (USDbn) | Employment (millions) | Key Products | Export Share (%) |

|---|---|---|---|---|---|

| Surat | Gujarat | 10.4 | 2.2 | Synthetic yarn, polyester, viscose, printed fabrics | 20 |

| Ahmedabad | Gujarat | 6.8 | 1.6 | Cotton, denim, blended fabrics | 13 |

| Coimbatore | TamilNadu | 5.2 | 1.3 | Cotton, handlooms, knitted wear | 9 |

| Tirupur | TamilNadu | 4.1 | 0.9 | Garments, knitwear, sports apparel | 8 |

The numbers tell a clear story: Surat not only leads in revenue but also in employment and export contribution. While Ahmedabad remains a strong cotton hub, its dependence on raw cotton makes it vulnerable to price volatility, something Surat avoids by focusing on synthetics sourced from petro‑chemical feedstock.

Why Surat Beats the Competition

Several strategic advantages push Surat ahead:

- Infrastructure. The city benefits from the Gujarat State Power Grid, which ensures uninterrupted electricity-a critical factor for high‑speed textile machinery.

- Port proximity. Hazira and Surat ports handle over 70% of the city’s export cargo, cutting shipping time and costs.

- Policy support. The Gujarat Textile Policy (2022) offers 10‑15% capital subsidy for modern looms and a 5‑year tax holiday for green‑technology upgrades.

- Skilled labor pool. Over 1,500 vocational institutes in the region churn out trained technicians, designers and quality‑control experts each year.

- Cluster synergy. Ancillary industries-chemicals, dyes, packaging-are co‑located, creating a one‑stop ecosystem for manufacturers.

Government Initiatives Fueling Growth

The Indian Textile Ministry launched the National Textile Policy 2025, targeting a 15% increase in textile exports by 2030. Key measures include:

- Export credit guarantee schemes for small‑medium enterprises.

- R&D grants for sustainable fabric innovations (e.g., recycled polyester).

- Skill‑development programmes in collaboration with state technical universities.

Gujarat’s state government amplifies these efforts with its own Gujarat Industrial Development Corporation (GIDC) offering land at subsidised rates for textile parks, a factor that attracted foreign direct investment worth $1.2billion in 2023 alone.

Future Outlook and Emerging Challenges

Surat’s momentum looks set to continue, but a few headwinds could shape its trajectory:

- Raw material costs. Petro‑chemical price spikes can erode profit margins for synthetic yarn producers.

- Environmental pressure. The city’s rapid expansion has raised concerns over water usage and effluent discharge. The Gujarat Pollution Control Board is tightening discharge norms, prompting many mills to invest in zero‑liquid‑discharge (ZLD) technology.

- Global competition. Bangladesh and Vietnam are aggressively courting textile investors with lower labor costs. Surat’s answer-automation and skill‑upskilling-will be decisive.

Investors eyeing the Indian textile sector should monitor Surat’s policy environment, especially any updates to the Gujarat Textile Policy or central export incentives, as these will directly affect profitability.

Frequently Asked Questions

Which Indian city produces the most synthetic fabrics?

Surat, located in Gujarat, is the leading producer of synthetic yarn and fabrics, accounting for about 30% of India’s synthetic output.

How does Surat’s textile export value compare to other Indian hubs?

Surat contributes roughly 20% of India’s total textile export earnings, far surpassing Ahmedabad (13%), Coimbatore (9%) and Tirupur (8%).

What incentives does the Gujarat government offer textile manufacturers?

The Gujarat Textile Policy 2022 provides capital subsidies of 10‑15% for modern looms, a five‑year tax holiday for eco‑friendly upgrades, and subsidised land through GIDC textile parks.

Is cotton still a major product in Surat?

Cotton plays a minor role in Surat’s mix; the city’s strength lies in synthetic fibers, while cotton dominates in Ahmedabad and Coimbatore.

What environmental regulations affect Surat’s textile mills?

The Gujarat Pollution Control Board has mandated zero‑liquid‑discharge (ZLD) systems for large units and stricter effluent norms for dyeing and finishing processes, pushing mills toward greener technologies.