Pharmacy Profitability Calculator

Calculate Your Monthly Profit

Your Estimated Profit

Monthly Revenue: ₹

OTC Revenue: ₹

Prescription Revenue: ₹

Total Expenses: ₹

Net Profit: ₹

Profit Margin: %

Key Insight: Your OTC products generate % margin versus % for prescriptions. Increasing OTC sales by just 5% could add ₹ to monthly profit.

Owning a pharmacy in India isn’t just about selling medicines. It’s a high-volume, low-margin business that can turn steady cash flow into real profit-if you know where to look and how to manage the risks. Many people assume pharmacies are cash cows because everyone needs medicine. But the reality is more complicated. The margins are thin, regulations are tight, and competition is fierce. Still, thousands of pharmacy owners across India are making solid incomes. So what separates the profitable ones from the ones struggling to break even?

What’s the real profit margin in Indian pharmacies?

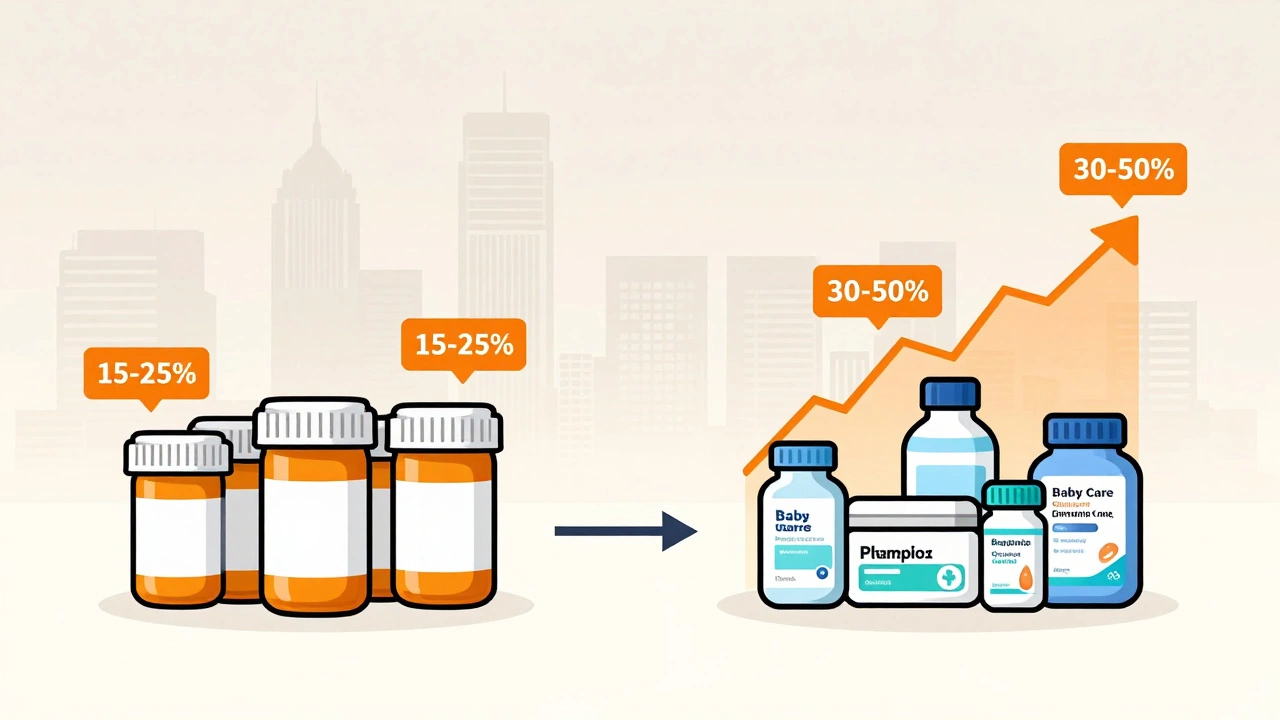

The average gross margin on medicines in a retail pharmacy in India sits between 15% and 25%. That sounds decent until you realize most of that gets eaten up by rent, staff salaries, electricity, and licensing fees. In a city like Bangalore or Hyderabad, a 500-square-foot pharmacy can easily cost ₹60,000 to ₹1,00,000 per month in rent alone. Add ₹30,000-₹50,000 for two pharmacists and ₹15,000 for utilities and software, and you’re already spending ₹1,05,000-₹1,65,000 just to stay open.

So how do you make money? You don’t rely on prescription drugs alone. The real profit comes from over-the-counter (OTC) products: vitamins, supplements, baby care items, diabetic testing kits, and personal hygiene products. These items carry margins of 30% to 50%. A well-stocked pharmacy can make 40% of its revenue from these non-prescription items, even though they make up only 20% of the total volume sold.

One owner in Ahmedabad told me his monthly sales were ₹8 lakh. Of that, ₹5.2 lakh came from prescriptions (18% margin), and ₹2.8 lakh came from OTC (42% margin). His net profit after all expenses? ₹1.1 lakh. That’s a 14% net margin-not flashy, but consistent. And in a country where most businesses fail within three years, consistency is gold.

How do pharma manufacturers India influence your profits?

You don’t buy medicines directly from pharma manufacturers India unless you’re a wholesaler. Most small pharmacy owners buy from local distributors. But the brand of medicine you stock matters. Generic drugs from big Indian manufacturers like Sun Pharma, Dr. Reddy’s, or Cipla have better margins than branded ones because they’re cheaper to buy and just as effective.

For example, a branded painkiller might cost ₹15 per strip and sell for ₹25. A generic version from the same manufacturer might cost ₹8 and still sell for ₹20. That’s a 150% higher margin on the same product. Many customers don’t care about the brand if the pharmacist recommends the generic. In fact, in tier-2 and tier-3 cities, customers actively ask for generics because they’re cheaper.

That’s why smart pharmacy owners build relationships with distributors who offer bulk discounts on top-selling generics. A single order of 5,000 strips of paracetamol from Cipla’s generic line can cut your cost per unit by 30%. That’s ₹1.50 extra profit per strip. Multiply that by 20,000 strips a month, and you’ve added ₹30,000 to your bottom line without raising prices.

Location is everything-but not where you think

You don’t need to be on a busy street corner. You need to be near where people live and get sick. A pharmacy inside a residential colony with 10,000 families will outperform one next to a hospital in most cases. Why? Because hospitals handle emergencies. Colonies handle chronic conditions-diabetes, hypertension, asthma. People need refills every month. That’s recurring revenue.

One owner in Pune opened his shop in a middle-class housing society. He didn’t advertise. He just gave free health check-ups every Saturday-blood pressure, sugar, BMI. Within six months, 70% of the residents became regular customers. He didn’t make more money per transaction. He made more transactions. Monthly sales jumped from ₹4.5 lakh to ₹9.2 lakh.

Also, avoid areas with more than three pharmacies within a 1-km radius. That’s a saturated market. You’ll end up in a price war. Instead, look for neighborhoods with one or two pharmacies and growing populations. Tier-2 cities like Indore, Jaipur, and Coimbatore are seeing rapid growth in pharmacy demand as healthcare access improves.

Regulations aren’t the enemy-they’re your shield

India’s drug licensing system is strict. You need a license from the State Drug Control Authority. You need a registered pharmacist on-site. You need proper storage for temperature-sensitive medicines. Many new owners skip these steps to save money. Big mistake.

One pharmacy in Lucknow was shut down for selling expired medicines. The owner didn’t know the expiry dates were printed on the box. He lost ₹4 lakh in inventory and ₹2 lakh in fines. He also lost his license for two years. That’s not a cost-it’s a catastrophe.

On the flip side, a properly licensed pharmacy gets trust. People will drive 10 kilometers to a pharmacy they know is legal and safe. In rural areas, where counterfeit drugs are common, being licensed makes you the only reliable option. That’s a competitive advantage you can’t buy with ads.

What you can sell beyond medicines

Most pharmacies in India only sell drugs. The profitable ones sell solutions. Think of your shop as a health hub.

- Diabetic care kits: Glucometers, test strips, insulin syringes

- Respiratory aids: Nebulizers, inhalers, oxygen concentrators (rental option)

- Maternity packs: Prenatal vitamins, baby formula, nursing pads

- Wellness subscriptions: Monthly delivery of multivitamins, protein powders, fiber supplements

- Home delivery: Free delivery for chronic disease patients within 3 km

One owner in Bhopal started offering monthly subscription boxes for hypertension patients. Each box included BP monitor calibration, 30 days of medication, and a consultation call with a pharmacist. He charged ₹999/month. He signed up 180 customers in four months. That’s ₹1.8 lakh in recurring revenue-no foot traffic needed.

How long until you break even?

If you invest ₹15 lakh to open a pharmacy (rent deposit, shelves, computer system, initial stock, license fees), you’ll need to hit ₹6-7 lakh in monthly sales to break even. That usually takes 10 to 14 months in a good location. If you’re in a high-demand area with low competition and you focus on OTC and subscriptions, you can hit that in 7 months.

The fastest-growing pharmacies aren’t the ones with the biggest signs. They’re the ones with the best systems: inventory tracking software, customer loyalty programs, and trained staff who can answer questions. A pharmacist who explains how to take a drug properly isn’t just doing their job-they’re building loyalty that lasts decades.

Is it worth it?

Yes-if you treat it like a business, not a side job. The average pharmacy owner in India earns between ₹80,000 and ₹2,00,000 per month after all expenses. That’s not billionaire money. But it’s stable, scalable, and recession-proof. People will always need medicine. Even in economic downturns, they’ll skip eating out before they skip their blood pressure pills.

The real winners are the ones who stop thinking like shopkeepers and start thinking like healthcare providers. They don’t just sell pills. They manage health. And that’s a business that doesn’t just survive-it thrives.